When building a home for the first time you may hear terminology you are not familiar with. From draw downs, earthworks to plate height it may all start to sound like another language. Here at Ultra Living Homes we want you to be as involved and understanding of the entire process as possible. Below are some common terms and phrases you may come across:

First Home Owner Grant (FHOG)

Introduced by the Government on the 1st of July 2000 for Australian Citizens, it was developed to help offset the effect of GST on first home buyers. The scheme varies state to state however it is generally a one-off payment for those who satisfy specific criteria to help them break into the property market for the first time. Currently, the FHOG is $30,000 for contracts signed between 20 November 2023 and 30 June 2025. For specific information relating to Queensland first home buyers grant click the link below:

Borrowing Capacity

The sum of money that a lender or bank can loan to you. Many factors will influence your borrowing capacity such as: salary, monthly expenses, assets, equity, existing loans etc.

Stamp Duty

Stamp duty (also referred to as transfer duty) is a tax levied on the transfer of property. When purchasing a house and land package the stamp duty is only paid on the land – not the house which offers buyers quite the saving.

Fixed Rate Home Loan

A fixed rate home loan is a loan whereby the interest rate is locked in for a certain period. Over this time regardless of what is happening in the market your loan repayment amounts, and interest rate will not change. This is great for some people as it gives you peace of mind as to what your exact repayments will be!

Variable Home Loan

A home loan in which the interest rate fluctuates on the outstanding amount as market interest rates change. When interest rates decline, variable home loan borrowers will benefit as the repayments on their loan will decrease as well. However, when the interest rates rise, borrowers on a variable home loan will find the amount payable on their loan also increases.

Guarantor

A guarantor is someone who will agree to honour your contract if you are unable to make your repayments. Acting as a guarantor means you are guaranteeing that you will continue to pay the loan or mortgage in the event the borrower is unable to do so. Having a guarantor on your loan can make lenders more inclined to approve the loan. First home buyers often use a parent or legal guardians as a guarantor. This can help, particularly if you do not have sufficient deposit, but your parents can guarantee the deposit by using equity in the family home.

Pre-approval of Finances

Pre-approval is an important step in building your first home. It gives you an indication of the amount a lender will lend you which will help you narrow down options within your price range. Pre-approval is not a guarantee that the home loan will be funded, so you still need to get final approval. Whilst not mandatory to seek pre-approval, it can make the overall process easier both in terms of seeking finance down the track and also knowing what budget you should be working towards.

Formal Finance Approval

Also referred to as unconditional loan approval, Formal approval is the point at which the lender has everything required to approve your loan. Once this is granted, the sale of land can proceed. To achieve formal finance approval, the bank will require two contracts; one for the land and one for the build.

Drawdowns

A drawdown is a progressive payment from your loan funds released to the builder at various stages of construction. At Ultra Living Homes, we use HIA contracts which specify set percentages for each major milestone such as deposit, slab, frame, enclosed, fixing and practical completion.

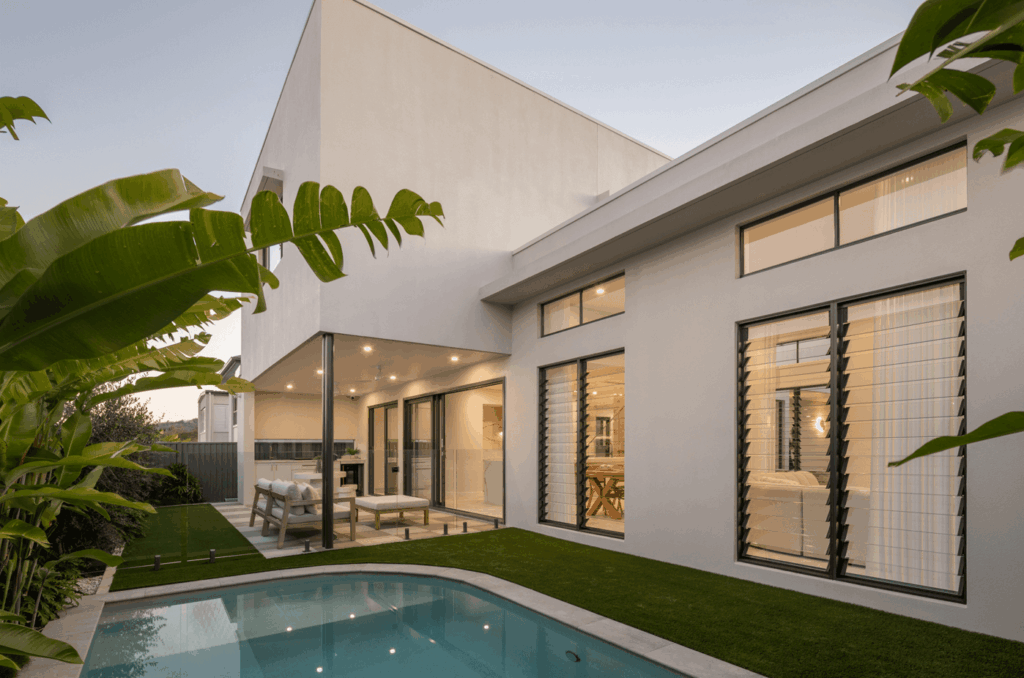

House and Land Packages

The purchase of both land and the construction of a new home at a fixed price. House and land packages are a fantastic way for a first home buyer to enter the property market as they represent great value. Ultra Living Homes have a great range of fixed price house and land packages available. The benefit of a fixed price contract is in knowing your full costs upfront with no hidden surprises.

Land Title

Before construction can start on your home, you need to prove ownership of the land. This comes in the form of a Land Title which is a certificate or deed confirming your legal ownership of the property.

Estate Covenants

In a new estate, developers often create design guidelines to ensure consistency amongst homes when it comes to design, style and overall appearance. These are commonly referred to as Estate Covenants. When purchasing land in a new estate, it is important to see if there are any specific guidelines your home will need to adhere to. When building with Ultra Living Homes, we ensure that any Estate Covenant requirements are addressed early to ensure a smooth approvals process.